my future fund - 2026!

From 1st January 2026, Auto enrolment (My Future Fund) will apply to some staff. This is a mandatory scheme and once an employee qualifies, they will be automatically enrolled in the scheme.

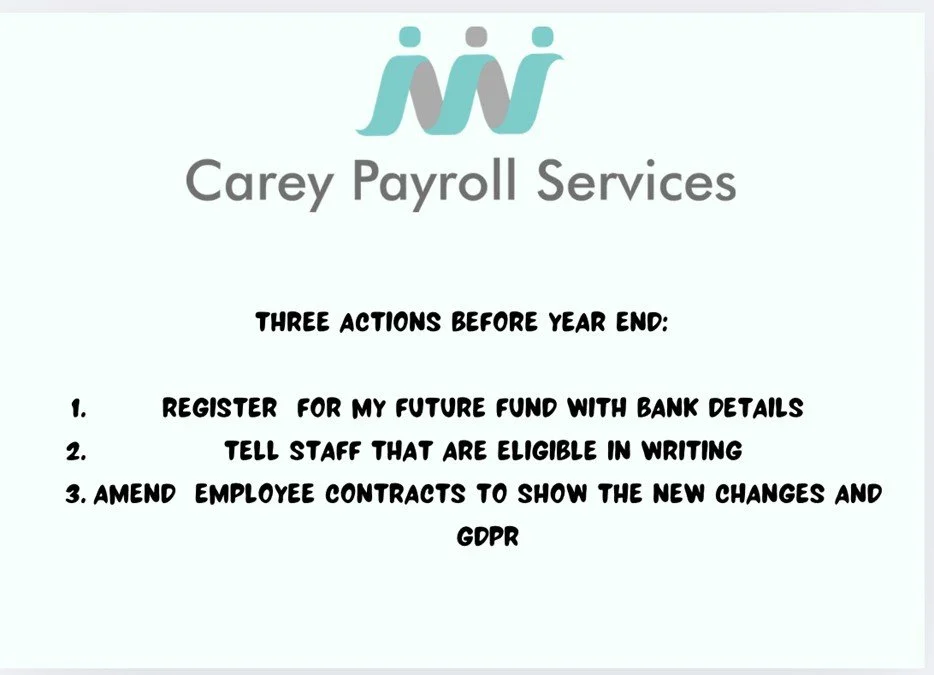

Important!! What needs to be done before the end of the Year?

All employers must register with My Future Fund (Important to include Bank details for payment) (they are encouraged even if they don’t have staff eligible now)

It is my strong recommendation that setting up a Variable Direct Debit is essential as paying by credit cards will attract fines and charges if any deadline is missed – weekly payroll is weekly payments and monthly will be monthly payments

Please register as soon as it goes live on 8th December 2025 – log into www.myfuturefund.ie (Not live yet)

Employers need to ensure Employee Pensions and Employer Pensions are recorded in the Software and submissions to Revenue.

Staff need to be informed by their employee once it is confirmed that they are eligible. (I have attached an editable version of a memo to staff available to clients) Onus is on the employer to ensure this. Revenue have said that the Employer has 14 days from when they are alerted that the employee is eligible for the scheme to tell the staff member. ( I would suggest an email to follow up the conversation as it covers this off)

Contract Amendments need to be issued no later than January 1st, 2026 (this needs to be added to staff contracts)( an example of an add on page is available to clients. Note: this is just an example, this can be edited and checked to reflect your specific business and employees) Note: Private pension employees should have an amendment in their contract citing this too. (employees that operate private pensions only)

After Year-end (From 1st January 2026)

Auto enrolment pension contributions will be processed through payroll software and as employees become eligible, it will automatically enter them as they go along – this will come in through the current ROS Cert and will need to be paid each week for weekly and monthly when payroll is completed monthly.

Important! Corrections cannot be made after 6.30pm on the Payday of the week – NAERSA will lock payslips after this (can never be deleted or changed) as they issue the payment requests to bank accounts

Who will be included automatically?

Eligibility criteria

Age: Between 23 and 60 years old

Earnings: Earn more than €20,000 per year across all employments

Pension status: Not currently paying into a work or private pension through payroll deductions

Here are a few quick facts that arose during my training with multiple outlets in preparation for My Future Fund:

This scheme will be paid out on retirement alongside the state pension (in addition to it)

Proprietary Directors and Self-employed individuals are not eligible for the scheme.

The Gross that the 1.5% will apply to will be Salary including Overtime, Bonus, Commission, BIK and Share based Renumeration.

Employees can opt out after 6 months and their employee contributions will be refunded to them – Employer contributions will not be refunded and will be available for the employee to take at retirement age.

Employees that have opted out will be automatically reassessed in 2 years

Employees can also suspend their contributions but must wait 12 months before re-entering the scheme.

The scheme is open to 18–65-year-olds of all income – if Staff that earn under €20,000 a year wish to opt in to the scheme; the employer cannot refuse them and must pay the contributions and operate the scheme

Research has shown that by 2030, the average Life expectancy will be 86 for Men and 88 for Women and that on average on the current State pension amount, each person will have a shortfall of 10,000-15,000 per annum without a private pension or personal savings.

Some good sources of Information:

https://www.careypayrollservices.ie/blog/auto-enrolment

https://psc.ie/what-is-auto-enrolment/

https://www.citizensinformation.ie/en/money-and-tax/personal-finance/pensions/auto-enrolment/

Two further online information sessions will be held by the department on 3 December at 2pm and 4 December at 2pm. This is a valuable opportunity for employers to learn about auto-enrolment and ask questions.

3 December

https://www.eventbrite.ie/e/myfuturefund-3rd-december-tickets-1968154328578?aff=oddtdtcreator

4 December

https://www.eventbrite.ie/e/myfuturefund-4th-december-tickets-1968155133987?aff=oddtdtcreator